1. Introduction

As a geographically remote and technologically developed nation, Australia is considerably reliant on space technologies for both civilian and military applications. Ranging from satellite telecommunications to weather forecasting and military intelligence, these applications are ubiquitous. At the same time, the space environment has become increasingly contested with the rise in rate of effort of launches from other countries, and threats from electromagnetic and cyber warfare.

In light of these circumstances, it is prudent for Australia to pursue expansion of sovereign spaceflight capability, currently spearheaded by a number of startups such as Gilmour Space Technologies (Gilmour Space Technologies, 2024). Such expansion would bring us in line with our allies and geographic neighbours while also ensuring that critical Australian space assets can be readily replaced in the event of a catastrophic event. While historical attempts at building a sovereign space access capability have failed, the development of new technologies can reduce the technical difficulty of this endeavour as has been the case in other countries. Commercial opportunities may also arise from the continued development of sovereign space capabilities.

2. Past attempts at Australian space access

Since the dawn of the space age, Australia has embarked on space launch activities with varying levels of success. The first and most notable of these was the Anglo-Australian Joint Project conducted at the Woomera Test Range during the dawn of the space age (Dougherty, 2022). Born out of British concerns of Soviet nuclear missiles, the Woomera range started as a range to test captured rockets and experimental missiles. The International Geophysical Year (1 July 1957 to 31 December 1958) saw the first rockets launched from Australia to pass the Kármán line with an Australian-built Long Tom and a British-built Skylark sounding rocket being launched from the Woomera Test Range (Wade, 2019). These rockets were equipped with scientific instruments to measure characteristics in the upper atmosphere. The Long Tom sounding rocket was followed by several other Australian sub-orbital rockets until the last launches in 1976 (Dougherty, 2006).

Concurrently, there were several international partners using the Woomera Test Range for their own space programs with the United Kingdom’s Black Arrow orbital rocket, the European Launcher Development Organisation’s (ELDO) Europa rocket, and the tripartite Sparta re-entry research program between Australia, the United Kingdom and the United States (Morton, 1989). The last of these three programs also enabled Australia to launch its first satellite from Woomera with the Weapons Research Establishment Satellite (WRESAT) being launched by a spare American Redstone rocket in 1967 (Forbes, 2018). While these projects were not Australian, there were missed opportunities for furthering the Australian space industry, with WRESAT not being followed by other Australian satellites, and invitations to join the European Space Agency (ESA) as a result of Australia’s contributions to ELDO being rejected.

Following the demise of this initial space launch activity, satellite launch requirements for the Australian government and industry have since been met by international partners. However, numerous failed attempts at Australian launch capability took place throughout the 20th century with an example being the proposed Spaceport in Cape York, Queensland which sought to take advantage of its proximity to the equator (John Oxley Library, 2013). This proposed facility failed due to several political and economic factors such as challenges incorporating American payloads on Russian-built rockets, legal disputes with the local Indigenous population and a lack of funding.

Another notable attempt at developing an Australian launch capability is the Australian Space Research Institute’s (ASRI) AUSROC program which drew upon resources from several academic bodies, second-hand Royal Australian Air Force (RAAF) missiles and the remnants of the Woomera Test Range (Australian Space Research Institute, n.d.; Department of Defence, 2015; Wikimedia Foundation, 2024). As noted by a submission to a 2008 Senate Inquiry into the Australian space industry, ASRI’s AUSROC program is a ‘series of launch vehicles culminating in the launch of a microsatellite into earth orbit’, (Samuel, 2008). While this program failed to send a satellite to orbit, it succeeded in enhancing ASRI’s role in space advocacy with the same submission noting that several past participants of the AUSROC program went on to establish themselves as key stakeholders in the Australian space industry.

3. Status quo of Australian launch capabilities

For the purposes of this paper, a domestic launch capability is the ability to launch a rocket into space which occurs within Australian soil. Technologies associated with the launch can include those made within Australia as well as by overseas firms as long as they are launched from within Australian soil. On the other hand, a sovereign launch capability is a launch of a rocket into space involving technologies developed by Australian entities. While Australia has not yet regained a sovereign launch capability, several key developments are underway. Currently, Australian startup companies such as Gilmour Space Technologies, Black Sky Aerospace, and ATSpace are aiming to develop their own rockets capable of carrying small satellites to orbit (ATSpace, n.d.; Black Sky Aerospace, 2024; Gilmour Space Technologies, 2024). Out of these firms, ATSpace has attempted to launch suborbital rockets without success, while Gilmour Space is preparing to launch their Eris orbital class hybrid rocket in 2024. Common to these two firms is their use of hybrid motors as opposed to more conventional solid or liquid motors[1]. These motors possess a number of advantages and drawbacks to be discussed further on.

Similarly, launch providers such as Equatorial Launch Australia (ELA), Southern Launch and Western Australia Spaceport have established spaceports (Equatorial Launch Australia, 2023; Southern Launch, 2024; Western Australia Spaceport, n.d.). These spaceports are platforms where rockets can be launched. The first two of these spaceports have successfully hosted overseas suborbital launches, a series of National Aeronautics and Space Administration (NASA) sounding rockets and a Dutch suborbital DART rocket carrying a payload for Australian firm Ascension (formerly DEWC Systems) respectively. The signing in October 2023 of a Technology Safeguards Agreement with the United States (US) will enable American rocket companies to launch from Australian spaceports, hence providing more opportunities for spaceport providers (United States Department of State, 2023). However, these launches will not necessarily constitute a sovereign launch capability since some will be carried out by overseas entities with overseas technologies.

Despite these technical and commercial developments, several hurdles must be overcome to restart a domestic launch capacity and a sovereign launch capacity. The first of these hurdles is regional competition, both in terms of commercial launchers, such as Rocket Lab operating in New Zealand, and spaceports, such as proposals for launch facilities in Indonesia (British Broadcasting Corporation, 2020; Rocket Lab USA Inc., 2023). These competitors are at various stages of maturity ranging from proposals to commercially profitable enterprises. Australian launch startup companies may struggle competing with established players in the global launch market and, as such, government support to these firms may be required as they grow and develop. Another hurdle is creating the workforce capable of developing and sustaining a launch capability. Historically, a lack of domestic space industry has meant that skilled workers have moved overseas upon getting their qualifications with one respondent to the 2008 Senate Inquiry ‘preparing to move with my family to Europe for the prime reason of working in the Space industry’, (Parliament of Australia, 2008, p. chap. 5.33). This challenge is compounded by demands from other defence and non-defence priorities such as the Australia-UK-US (AUKUS) technology sharing agreement and the transition to renewable energy.

4. Why is sovereign launch important?

Traditionally, it was believed that Australia did not need to gain its own launch capabilities and instead should prioritise effective use of other nation’s space data. When announcing the predecessor to the current Australian Space Agency, the Space Coordination Office, in 2013, media statements from Innovation Minister Kate Lundy explicitly ruled out work related to ‘astronauts, domestic launch capabilities or to the exploration of other planets’ (Nine Network, 2013). Such sentiment was also held within the private space industry with space archaeologist Dr Alice Gorman reflecting that ‘For decades it was received wisdom in the Australian space community that we would never launch again’ (Gorman, 2021). Despite this belief, several key factors have meant that sovereign launch is now pivotal to our space capability.

The first of these key factors is the rapidly changing nature of the global space industry reducing the financial and technical challenges of such an endeavour. While previously, space launch was only conducted by superpowers and major powers such as the US, the former Soviet Union and China, increasingly space access is being achieved by private companies and middle powers. An example of this is Rocket Lab, which was founded in New Zealand and with headquarters in the US, conducting most of its launches from New Zealand. Such developments are made possible through the miniaturisation of electronics and hence satellites, making it possible for smaller and simpler rockets to be able to carry practical payloads at an accessible cost.

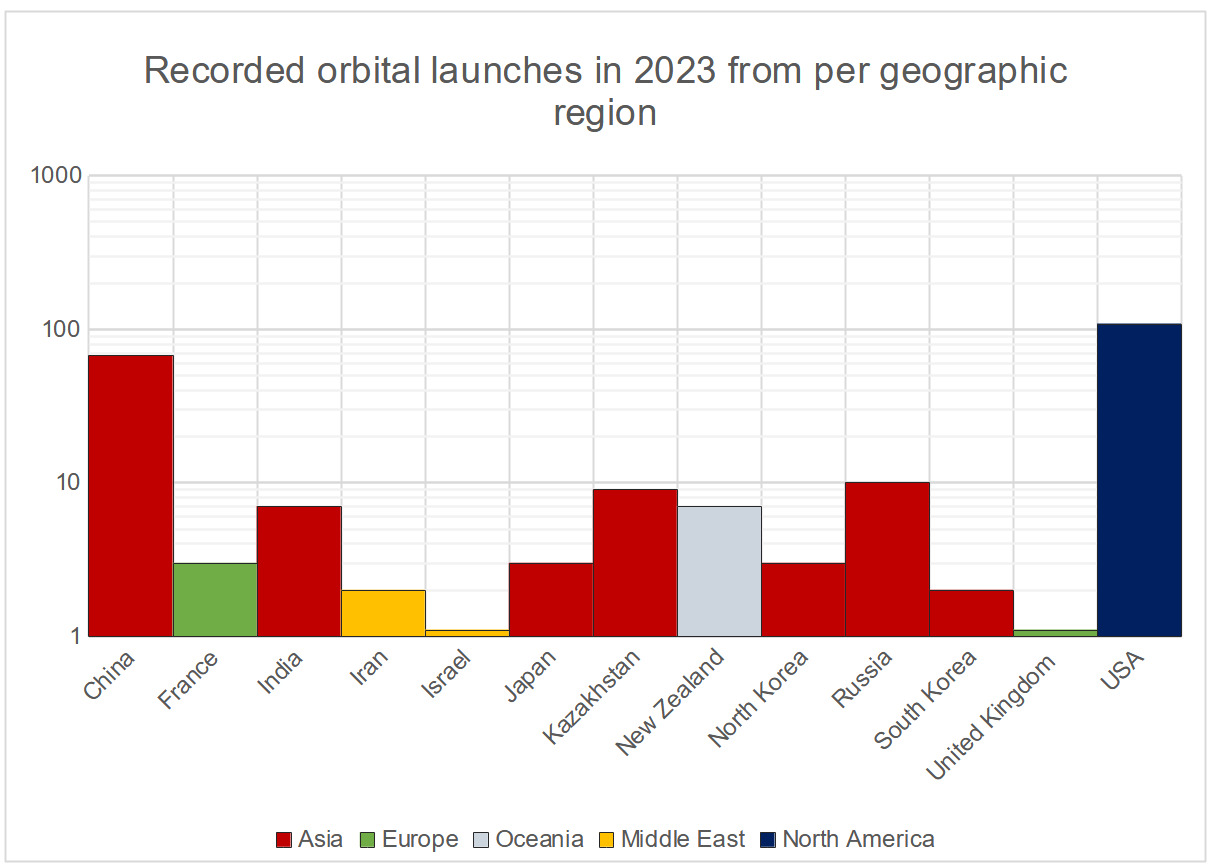

Conversely, the space domain is becomingly increasingly contested with countries testing various methods of anti-satellite (ASAT) warfare such as kinetic interceptors, electronic warfare, directed energy methods such as lasers, and even the use of interceptor satellites which can grab a target satellite in orbit (Tingley, 2022). In the case of a wide-scale conflict, Australian satellites may be targeted. In such a scenario, allies may also prioritise their own space capability requirements and hence refuse to replace Australian satellites. As such, to ensure reduced disruption, it is advisable for Australia to pursue sovereign space capabilities. Figure 1 illustrates the rate of effort of launches from various countries over 2023, demonstrating the need for sovereign space access.

5. Australia’s answer to sovereign launch

To meet Australia’s domestic launch requirements, value for money must be taken into account. With Australia’s small scale of economy, it would not be practical to launch a Geosynchronous Transfer Orbit (GTO) or Geosynchronous (GEO) class rockets such as the SpaceX Falcon 9. The SpaceX Falcon series has history in development since the early 2000s and is approaching a total of 300 launches costing US$69.75 million per launch (SpaceX, 2022). Though cheapest in its class, Australia simply does not possess the expertise or resources to match this. Australia should focus on Medium and Low-Earth Orbit (MEO/LEO) launches for the applications of communications and earth observation satellites in Sun Synchronous Orbits (SSO). The previously mentioned launch providers, ELA and Southern Launch, are positioned to satisfy a range of orbital requirements. Southern Launch’s Whalers Way complex is suited for polar and SSO orbits (Southern Launch, n.d.); whereas launches from ELA’s pad in Arnhem Land lends to more efficient launches due to its proximity to the equator (Equatorial Launch Australia, 2023).

For these launches, the type of rocket must be considered. Liquid rockets are highly efficient rockets utilising liquid fuel and oxidiser at cryogenic levels stored at high pressures. These systems require complex plumbing such as turbo-pumps, however, can throttle and control the thrust profile for precise control to a desired orbit. Solid rockets conversely are simple, cheaper, easy to manufacture due to castability and generally less risky than liquid rockets due to their low volatility. They are not as efficient or powerful as liquid rockets and once ignited the reaction cannot be halted, giving for a pre-defined thrust profile. Hybrid rockets combine the best of both and the worst of both solid and liquid motors. Without needing the complex plumbing of liquids engines but still more difficult to work with than solid rockets, these rockets are inherently safer and possess the ability to throttle. They provide higher efficiencies than solid rockets but not as high as liquid rockets.

Most importantly, the maturity of the solid and liquid engine technology also prohibits the feasibility of hybrid rockets. Of note, Gilmour Space is developing their Eris class hybrid rocket, however their technology has yet to become space proven with a test launch due for 2024.

6. Growing a sovereign launch capability

Australia needs to recover, grow and sustain its sovereign advanced manufacturing capabilities. ‘[T]o mitigate risk and improve resilience Australia should invest extensively to become a spacefaring nation by producing, launching and managing spacecraft systems’ (Lovett, 2015). An overview of current and future capabilities identifies a highly potential synergy to other ADF priorities due to shared technologies.

Firstly, the Guided Weapons and Explosive Ordnance (GWEO) enterprise with its emphasis on rocket and scramjet propelled weapons is set to benefit strongly from a renewed launch capability. The capabilities and supply chain in developing a sovereign launch capacity would have commonalities with GWEO’s requirements, thus reducing financial and scheduling costs. An overseas example of such a development is France’s Ariane Group, which manufactures space launch vehicles and long-range missiles such as submarine launched ballistic missiles and hypersonic missiles (ArianeGroup, n.d.). Within Australia, Defence has signed a $37.4 million contract with Lockheed Martin Australia to manufacture missiles for the Guided Multiple Launch Rocket System (GMLRS) beginning in 2025 (Blenkin, 2024). This shows a promising outlook and commitment to growing domestic manufacturing for use in projecting land power through the air domain.

Furthermore, solid rocket motors play a small but vital role in propelling mid-course phase interceptors as part of an Integrated Air and Missile Defence (IAMD) system. In 2023, Australia tested the National Advanced Surface to Air Missile (NASAMS) in the Woomera Test Range which is planned to launch the Advanced Medium Range Air to Air Missile (AMRAAM) and AIM-9X missiles part of Army’s Project Land 19 Phase 7B (Marquis, 2023). Considering GWEO’s long term plan for establishing local manufacturing (Kapil, 2023), it can be deduced that the missiles part of the Joint IAMD system will be manufactured in Australia. Synergies between IAMD, GWEO and sovereign space launch can be appreciated due to the shared technologies of missiles and launch vehicles. This will enable reduced costs for solid rocket motors in Australia, assist in growing a wide breadth of skilled workers to support the industry, and place Australia as a key global player for access to space.

Building the workforce is a crucial aspect required to strengthen a sovereign launch capability. Historically, Australia has faced a significant ‘brain drain’ of space qualified professionals to the likes of NASA and US Primes. Such a brain drain has impacted our adaptability to the rapidly changing nature of the modern space industry. Investing in a launch industry will cultivate a sovereign skill base and supply chain thus improving the overall capability of our space industry (The Australian Financial Review, 2021). The Defence Space Strategy aims to deliver a mature workforce within the 2030s and 2040s (Defence Space Command, n.d.) and the Civil Space Strategy aims to create an additional 20,000 space jobs by 2030 (Australian Space Agency, 2019). These long terms goals, combined with leveraging existing initiatives, will assist in accelerating the growth for the launch sector. For example, iLAuNCH Trailblazer, a joint initiative delivered by the Department of Education to ‘build new research capabilities, driving commercialisation outcomes and investing in new industry engagement opportunities’ (ILAuNCH, 2024) has a focus on rocket manufacturing and launch.

7. The sovereign launch greater picture

The National Defence: Defence Strategic Review (DSR) identified changes to Force Structure and Capability that ‘Defence must consider the level of sovereign capability need’ (Houston & Smith, 2023, p. 62). With established sovereign launch capabilities, Australia can fulfill space power mission areas outlined in the Space Power Manual (Defence Space Command, 2022, p. p.18) without having to rely solely on its allies. This will enhance the whole-of-government effort to secure its national interests and to support its allies. Sovereign launch also reduces Australia’s dependability on its allies for when an Australian specific mission is to be met. This equips Australia to become a more adaptable force throughout the space domain, increasing responsiveness and reach.

It must be understood that sovereign launch itself is not enough to secure the space domain. It is a joint effort from all instruments of national power with a whole-of-government strategy. Lovett (2018) mentions in re-focusing Australia’s space priorities away from a military focus: ‘A strategy integrating the broader elements of space power – government, military, industry and academic – would enhance Australia’s contribution to safeguarding this critically important domain’ (Lovett, 2018). This sentiment is echoed by Moss (2023): ‘there is no national space strategy that approaches space from a whole-of-nation perspective and bridges the civil-military divide in space.’ Moss also highlights the future of Australia’s space capability need not be a dilemma between dependence or independence from the US in space capabilities but rather consider the spectrum of reliance and sovereignty (Moss, 2023). This is to be dictated by Australian space needs and what constitutes an appropriate degree of control over capabilities.

Conclusion

Australia has been fully reliant on its allies for space capabilities in the past since the end of the Anglo-Australian Joint Project at Woomera. Now Australia is at a point where the need for sovereign launch access is to be seriously addressed in light of the current and predicted geopolitical climate. The Australian space industry has seen steady growth in the past few years, however no sovereign company is yet able to provide the full gamut of space capabilities. Therefore, Australia must leverage and fully support its academic and technical expertise in the industry. By capitalising on its unique geography, Australia will ensure vital access to the highly contested domain. Startup launch companies are still young and growing; however, launch is only one component in fulfilling space power roles. Defence should consider the synergy of shared technologies in GWEO and IAMD capabilities for launch vehicle manufacturing. Defence’s needs should be assessed with an overall national space strategy for addressing all of Australia’s space interests. This includes the need to evaluate the balance of reliance and sovereignty for space capabilities to ensure a value for money solution.

A liquid motor is a type of rocket engine that combines high pressure liquid fuel and liquid oxidiser in a combustion chamber to produce thrust (Sutton & Biblarz, 2017).